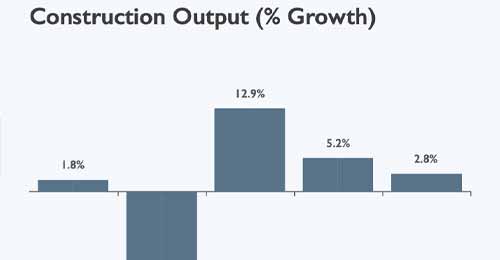

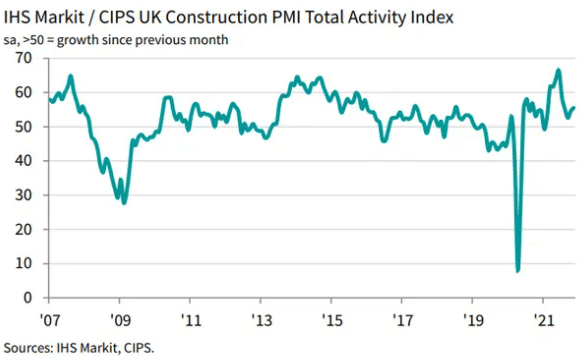

November 2021 saw construction sector output grow at its fastest rate in four months. Evidence suggested that the supply chain was overcoming the issues that caused drag over recent months.

The IHS Markit and Chartered Institute of Purchasing & Supply (CIPS) latest data revealed the seasonally adjusted Construction PMI Total Activity Index (PMI) for November was up at 55.5 from October score of 54.6.

The proportion of construction companies reporting delays from suppliers fell showing a downward trajectory from 63% in September and 54% in October down to the current 47% in November. This reveals a clear trend and a marked increase in confidence in the sector that the supply chain problems were over their worst.

The issues have not disappeared completely however with only 4% reporting an in improvement in supply lead times and the shortage of HGV drivers again being the cause for delivery delays in getting materials to sites.

72% of respondents did report an increase in purchase prices in November, while only 3% reported a decline.

What do industry leaders have to say about the increase in Construction Output?

Duncan Brock, group director at CIPS, said: “47% of construction firms reporting longer waiting times is the smallest number for eight months.

“Even with this glimmer of hope that the pressure on deliveries easing, purchasing remained at higher level to counteract disruptions from ongoing driver shortages and port delays as supply chain managers bought more than their immediate need.”

Even with the situation improving, economists cautioned that the Omicron variant of Covid-19 threatened to disrupt construction sites in the coming winter months.

KPMG head of infrastructure, Jan Crosby, said: “While so far the new variant has had little to no impact on activity, it’s difficult at this stage to see how this plays out. Another tightening of restrictions, which could see more workers needing to self-isolate, could create further delays or shut down sites altogether. It is a shame there is so much to contend with because the fundamentals in the industry remain robust.”

And Max Jones, the director of Lloyds Bank’s infrastructure and construction team, added: “While a full-scale lockdown looks unlikely, a return to the volatility felt earlier in the year when sites were depleted by quarantine requirements will strain contractors, especially smaller players with leaner workforces.”

Tim Moore, director at IHS Markit, says UK builders saw a welcome combination of faster output growth and softer price inflation last month.

“Input price inflation remains extremely strong by any measure, but it has started to trend downwards after hitting multi-decade peaks this summer.

The latest rise in purchasing costs was the slowest since April, helped by a gradual turnaround in supply chain disruption and a slight slowdown in input buying. Port congestion and severe shortages of haulage capacity were again the most commonly cited reasons for longer lead times for construction products and materials.”

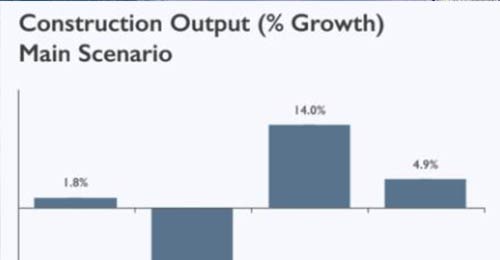

The latest monthly figures show output increasing in each of the last 10 months with the figure in June reaching 66.3, a 24 year high.

The commercial construction sector overtook housebuilding with a score of 56.5 and was the best performing with the latter’s score falling from 55.4 to 54.7 from the previous month. Civil engineering saw its score at the largest since August but still trailed other sectors.