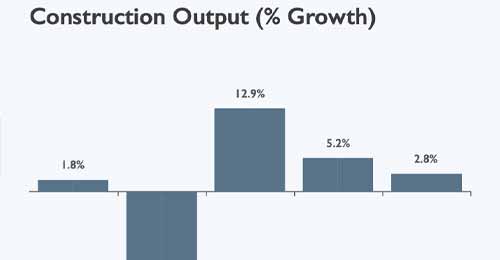

Four major cities across the UK reported increases in construction by over a third last year with the industry sparking back after the lockdowns due to the 2020-2021 Pandemic.

Early indications show no sign of residential activity slowing in 2022 with prospects good despite some warning signs of insolvencies for relatively large and small players blamed on a myriad of factors from Brexit to the Pandemic.

72 new projects started in Belfast, Birmingham, Leeds and Manchester in 2021 according to Deloitte’s regional crane survey an increase from 53, in 2020.

The construction of 19,763 new homes was in progress in the 3 English cities in 2021, marking the second-highest total on record over the last 20 years. Belfast saw no new residential projects of more than 25 units under way, although major schemes are expected to take off this year.

Student-accommodation numbers increased by 23 per cent in 2020 with Leeds leading the way with a 136 per cent rise in student housing schemes. Belfast saw an increase of just 4 per cent in the year.

The general uptick was due to residential schemes with Leeds growing by 210% on the previous year in the number of housing units starting construction. 10 new residential schemes started in Leeds in 2022, the greatest figure since 2006.

There were 14 new residential schemes started in Birmingham in 2021, an increase of 5 on 2020. However, new home numbers dipped from around 2,000 in 2020 to just over 1,500 in 2021 remaining well above a 10-year average of 653 new homes per annum.

Leeds centre saw work on the Majestic Building Centre completed by Sir Robert McAlpine, which is destines as Channel 4’s new base.

5,500 new homes were built in Manchester dubbed ‘Manchattan’ in 2021, an increase of 500 from 2020. An additional 10,700 homes remained under construction in the city across 40 development sites.

Office projects were at their highest since Deloitte’s first survey in 2017 in Belfast in 2021 although no new housing schemes were started in the 2021 year, the city had 5 new schemes starting in 2020.

John Cooper, Deloitte’s real estate partner, said "Similar to residential growth trends in Manchester since 2014, Birmingham and Leeds have now also gained significant traction in new build to rent projects over successive survey years."

"This reflects favourable economic conditions and significant investment in placemaking."

Other cities failed to keep up with this pace with the number of office schemes under construction across all four cities decreasing to 3.48m sq ft in 2021 from 3.61m sq ft in 2020.

Completion numbers did fall significantly to less than 1.6m sq ft in 2021 from 2.5m sq ft in 2020. Deloitte blames the slowdown on the high volumes of development completed in 2020 and completion dates for projects last year trailing marginally due to the Covid pandemic.

Student accommodation and educational facilities under construction reported a 23% jump last year across the four cities, with record floorspace completed in both Leeds and Manchester.

Daniel Barlow, Deloitte managing partner for regional markets, said: "It’s encouraging to see overall construction activity remaining resilient across regional cities, despite a number of challenges."

"Regional cities are gearing up for a good pipeline of development for 2022. There is expected to be an uplift in construction across all sectors, as the levelling up agenda progresses, with further investment in centres."

Is the Covid pandemic still affecting the Construction industry?

Despite the effects of the Omicron variant emerging in 2022, last week’s IHS Markit/CIPS survey saw a jump in commercial work helping improve output last month.

This was contradicted by a Glenigan survey published this week, which reported that the values of smaller projects under £100m started falling at the end of 2020.

The report showed that in January 2022 the lowest value of project started since the start of the first covid-19 lockdown in 2020 and was the fourth consecutive month of declining values.

However, Recruiters such as RecruitEasy reported brisk activity in January 2022 with worker allocation numbers exceeding levels they would expect to achieve later in the year after the Easter period.

Commercial Director Paul Donnelly said: "The Southwest seems to have woken early from the New Year slumber and quickly ramped up activity in early 2022, particularly in housing.

"We are worked off our feet by our clients to keep pace with their demands for workers from plant operators to groundworkers, labourers and bricklayers.

"Although there was disappointing news regarding the Midas collapse in January 2022, it was encouraging to see competitors Bell Group quickly step in to snap up Mi Space the housing division."

"Let’s hope the administrators can quickly salvage the remaining projects as many local firms and people heavily depend on this".

So, a mixed bag of figures has greeted the industry in early 2022 with firms positive and braced for a surge in activity as soon as weather improves, days grow longer and covid restrictions subside.